Meta Description:

Explore how Real-World Asset (RWA) Tokenization is transforming investment landscapes, offering liquidity, fractional ownership, and global access to assets like real estate, commodities, and more.

Introduction: The Dawn of a New Investment Era

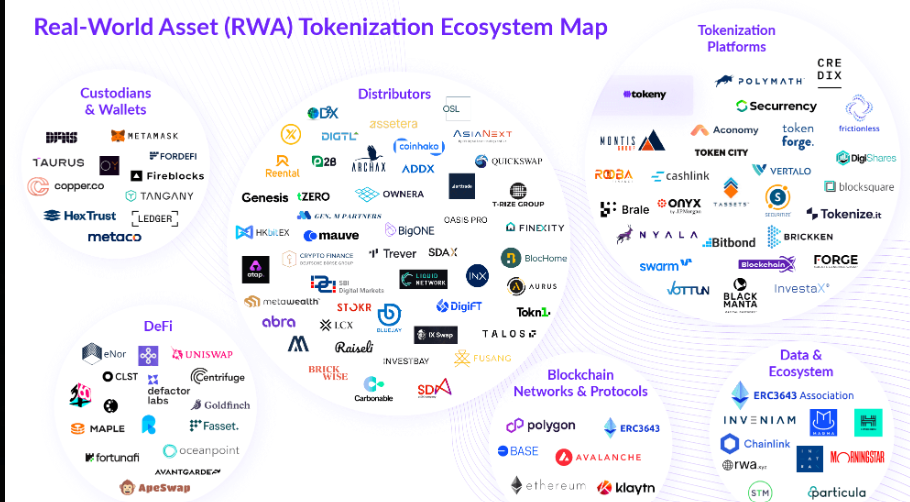

In 2025, the financial world stands on the brink of a transformative shift. Real-World Asset (RWA) Tokenization is emerging as a game-changer, enabling investors to access previously illiquid assets through blockchain technology. This innovation not only enhances liquidity but also democratizes investment opportunities, allowing fractional ownership of high-value assets.

What Is Real-World Asset Tokenization?

RWA Tokenization involves converting tangible assets—such as real estate, commodities, and bonds—into digital tokens on a blockchain. These tokens represent ownership shares, facilitating easier trading, fractional ownership, and enhanced transparency. By leveraging smart contracts and decentralized networks, tokenization streamlines asset management and opens new avenues for global investment.

Key Benefits of RWA Tokenization

1. Enhanced Liquidity

Tokenization transforms traditionally illiquid assets into tradable digital tokens, enabling faster and more efficient transactions. For instance, BlackRock’s tokenized money market fund on the Ethereum blockchain exemplifies how tokenization can facilitate real-time trading of previously illiquid assets.

2. Fractional Ownership

Investors can own fractions of high-value assets, lowering the entry barrier and diversifying investment portfolios. Tokenized real estate, for example, allows individuals to invest in premium properties with minimal capital.

3. Global Accessibility

Tokenized assets can be traded across borders, providing global access to diverse markets. This global reach expands investment opportunities and fosters international economic integration.

Real-World Applications and Case Studies

Real Estate

Tokenization of real estate enables fractional ownership, allowing investors to purchase shares in properties without the complexities of traditional real estate transactions. This approach enhances liquidity and provides access to a broader range of investors.

Commodities

Assets like gold and oil can be tokenized, offering investors exposure to commodities without the need for physical storage. This method reduces storage costs and simplifies the trading process.

Bonds and Securities

Traditional bonds and securities can be digitized into tokens, streamlining issuance, trading, and settlement processes. For example, TradeFlow’s tokenized commodity finance fund demonstrates how tokenization can enhance liquidity and accessibility in financial markets.

Overcoming Challenges in RWA Tokenization

Regulatory Compliance

Navigating the regulatory landscape is crucial for the success of RWA tokenization. Ensuring compliance with jurisdictional regulations, such as securities laws and anti-money laundering rules, is essential to mitigate legal risks.

Technology and Security Risks

While blockchain technology offers enhanced security, it is not immune to risks. Cybersecurity threats, smart contract vulnerabilities, and technological failures can pose significant risks to tokenized assets.

Future Outlook and Market Trends

The RWA tokenization market is poised for significant growth, with increasing adoption across various sectors. Financial institutions are exploring tokenization to enhance operational efficiency and create new revenue streams. For instance, JPMorgan and Apollo’s collaboration aims to transform wealth management through blockchain technology and tokenization.

Conclusion

Real-World Asset Tokenization represents a paradigm shift in investment strategies, offering enhanced liquidity, fractional ownership, and global accessibility. As technology advances and regulatory frameworks evolve, the potential for RWAs to reshape financial markets becomes increasingly evident.

People Also Ask (PAA)

What are the benefits of tokenizing real-world assets?

Tokenizing real-world assets offers benefits such as increased liquidity, fractional ownership, global accessibility, and enhanced transparency.

How does RWA tokenization work?

RWA tokenization works by converting physical assets into digital tokens on a blockchain, representing ownership shares that can be traded or sold.

What are the challenges of RWA tokenization?

Challenges include navigating regulatory compliance, addressing technology and security risks, and ensuring market adoption.

Call to Action

Stay informed about the evolving landscape of Real-World Asset Tokenization by subscribing to our newsletter. Join the conversation and share your thoughts on how tokenization is transforming investment opportunities.